What is a trading profit and loss account?

What is a trading profit and loss account?

Unlike the balance sheet, which was discussed briefly in the previous chapter and which will be looked at in more detail in the following chapter, the trading profit and loss account measures the performance of a company over a period of time as opposed to its capital or equity value at any given moment in time.

The TPLA is often produced more than once a year and, in theory, can be produced as often as a company sees fit. Although an official and formal profit and loss account satisfying Government guidelines will only be produced and submitted annually, directors and managers often prefer TPLA’s to be produced more regularly for internal purposes so that they can track how well the business is doing over shorter periods of time, e.g. on a monthly basis.

The profit equation

The index for a company’s performance over a given interval of time is of course its profit margin and, as always, profit is evaluated using the familiar equation shown below:

Profit = Revenue – Expenses (profit equation)

The profit equation is to the TPLA what the accounting equation is to the balance sheet. It aims to answer the all-important question any commercial business is most concerned about, namely:

“Have we made a profit or a loss?”

In chapter 7, I will be introducing the five accounting groups, from which the Revenue and Expenses Accounts make up two from five of these group categories. For now, I will simply state that it’s the financial summary information derived from both the Revenue and Expenses accounts which then needs to be fed into the TPLA in order to determine the final figure for a company’s net profit margin over a given period of time.

Gross profit and net profit

The two different types of profit a company can calculate are gross profit and net profit. These two figures will usually be shown against two separate headings on a TPLA. They are defined as follows:

Gross profit measures the profitability of buying or producing the company’s goods or services after those direct costs of sales have been deducted.

Net profit measures the final profit margin once all of a company’s other costs (e.g. wages, overheads, etc.) have been deducted from the gross profit margin.

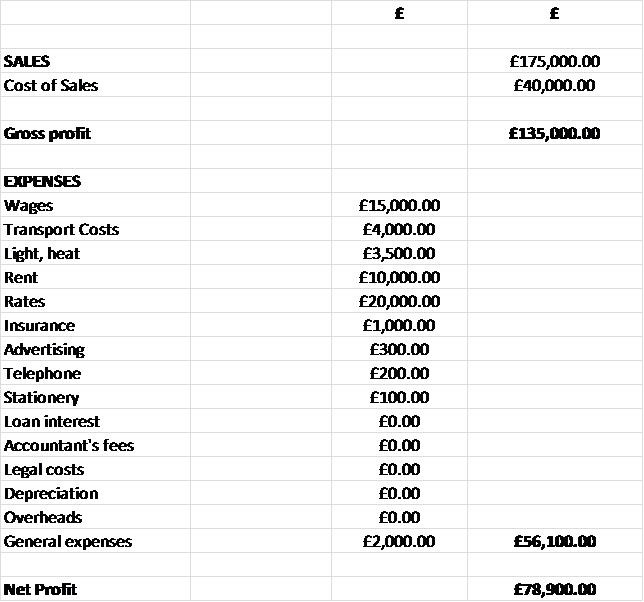

To end this chapter, I have shown you below the conventional layout for the trading profit and loss account. This particular example includes some of the typical subheadings you should include on your profit and loss within the ‘Sales’ and ‘Expenses’ columns.

Typical layout for the Trading Profit and Loss Account

In the above example, the final net profit calculation is given by:

Net Profit = Net Sales (i.e. Gross Profit) – Expenses = 135000 – 56100 = £78,900.00.