What is a balance sheet?

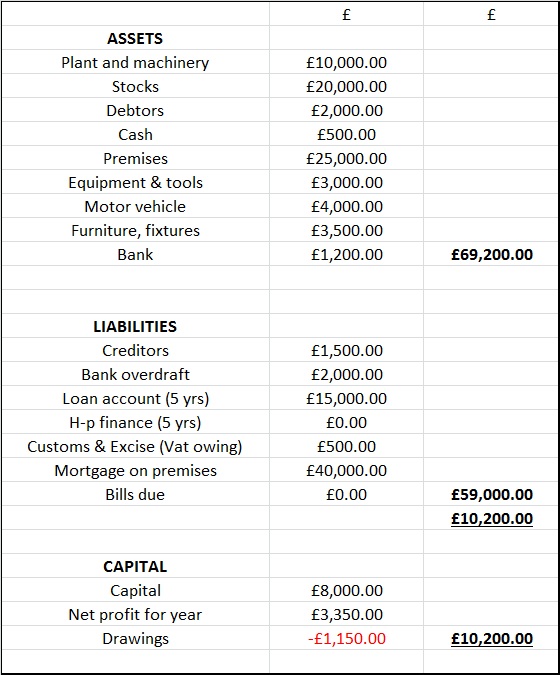

A balance sheet is a financial report which provides a snapshot of a company’s financial position at any given moment in time. It does this by evaluating a list of the business’s assets, liabilities and capital and, in so doing, seeks an answer to the question of what the business is worth.

A balance sheet is a financial report which provides a snapshot of a company’s financial position at any given moment in time. It does this by evaluating a list of the business’s assets, liabilities and capital and, in so doing, seeks an answer to the question of what the business is worth.

As discussed in chapter 3, the accounting equation is integral to the balance sheet as it uses the same variables (or accounting groups) of assets and liabilities in order to get at an answer to the question of a company’s capital worth. The balance sheet can then be thought of as a financial report which facilitates an appraisal of a company’s financial status by means of listing and quantifying its capital, assets and liabilities. This then enables a company to feed into the accounting equation the relevant values which will determine its own capital worth given by:

Capital = Assets – Liabilities (the Accounting Equation)

or abbreviated with initials:

C = A – L

The capital, assets and liabilities of a business will constantly change and need updating in response to day-to-day trading activities. These transactions will have an effect on one or more of the three accounting groups of capital, assets and liabilities, and so will have a direct impact on the evaluation of capital worth within the accounting equation.

In the same way that the left hand side of the accounting equation must equate to the right hand side, a company’s books must be made to balance. The balancing of the books is best demonstrated by the balance sheet, which will provide a neat summary of assets, liabilities and capital along with totals for assets less liabilities (A – L) and total capital (C). If the summary totals of A – L and C equate, the books are said to balance.

The double-entry method of bookkeeping is what ensures that the balance sheet always balances. By appreciating the dual effect each transaction has on a company’s accounts, and by correctly applying a debit in one place offset by a credit elsewhere, double-entry bookkeeping is able to guarantee that the difference between a company’s assets and liabilities always stays equal to its capital worth at any given time.

The principles of double-entry bookkeeping will be explored in further detail in chapter 8.

I will conclude this chapter by looking at a typical layout for a company’s balance sheet.