3. The Accounting Equation

At the heart of accounting is the ‘accounting equation’ shown below:

At the heart of accounting is the ‘accounting equation’ shown below:

Capital = Assets – Liabilities

This equation is used to calculate the capital worth of a business. At any given moment in time, the worth of a business will equate to the sum of its assets less the sum of its liabilities. In other words, the capital value is simply the difference between the assets and the liabilities of the business. This can also be viewed as the amount of surplus assets and money a business has in order to finance its liabilities.

By rearranging the equation above it’s easy to see the two alternative versions of the accounting equation as shown below:

Assets = Capital + Liabilities or

Liabilities = Assets – Capital.

Every transaction involving a flow or an exchange of money or value into or out of a business will have an impact on assets and/or liabilities and, in consequence, will affect the numbers which have to be fed into the accounting equation to determine how much a business is worth. For this reason, the accounting equation is integral to a company’s balance sheet.

On the balance sheet, a record is kept of all assets and all liabilities along with the difference between these two totals. If this difference is equal to (i.e. balances) with the separate figure of capital recorded on the balance sheet, then this is normally a good sign that the double entry credits and debits of all transactions are being recorded in their respective accounts accurately, and in the appropriate manner. This is what it means to ‘balance the books’.

The ultimate objective of both the equation and the balance sheet is the same, namely to ascertain a company’s worth by comparing its assets with its liabilities. The balance sheet simply provides the means necessary to facilitate the calculation set out in the equation.

The balance sheet will be covered in more detail in chapter 5, but I thought I’d mention it briefly at this juncture to help you see how it ties in closely with the accounting equation.

To conclude this chapter, I would recommend you try out the worked examples below to make sure you’re comfortable calculating any one variable from three (Capital, Assets or Liabilities) when the values for two are already known. These examples will also test that you’re able to rearrange the accounting equation when required and that you understand fully the financial ramifications for the various calculations.

Worked examples

1. A company’s assets are valued at £89,000 and its liabilities at £53,000. Calculate the net worth of the company.

Capital = Assets – Liabilities = 89,000 – 53,000 = £36,000

2. A company’s assets come to £25,000. How much capital is left over after the company has financed its liabilities of £22,000?

Capital = Assets – Liabilities = 25,000 – 22,000 = £3,000

3. A company has Capital of £12,740 and is financing liabilities of £11,400. Calculate the total assets for the business.

Assets = Capital + Liabilities = 12,740 + 11,400 = £24,140.00

4. A business with a net worth of £1,800 has assets amounting to £57,800. Calculate the total liabilities for the business.

Liabilities = Assets – Capital = 57,800 – 1,800 = £56,000

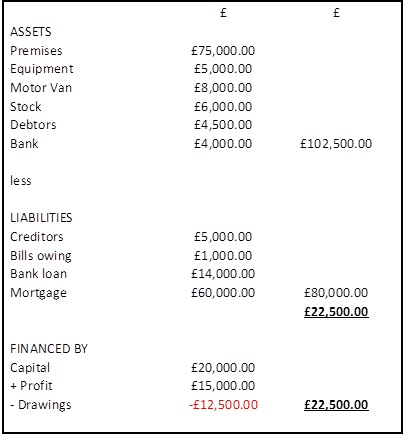

5. The balance sheet shown below reflects a company’s assets, liabilities and capital sums at the beginning of January. A list of January’s subsequent transactions are shown directly beneath this financial statement. Make amendments to the balance sheet to show the effect these transactions had on the individual values within the balance sheet, and thus, the net worth of the company.

Original balance sheet

N.B: Debtors are customers owing money to the business and are therefore viewed as an asset by the business. Creditors are suppliers that the business owes money to and are therefore viewed as a liability by the business.

Transactions during January

1. Debtors pay their accounts £2,750 by cheques and cash.

2. Bills of £250 are paid off by cheque.

3. Stock of £2,000 is purchased on credit from suppliers.

4. Creditors are paid £3000 on account.

5. Jack takes £500 for his own use.

6. Equipment of £1,500 is purchased on hire-purchase credit.

7. Stock is sold to debtors for £3,000 having cost £2,000.

8. £500 is paid off the bank loan.

Effect on Balance Sheet above

By comparing the two balance sheets above, we can see that the net capital worth has increased by £500 from £22,500 to £23,000. Notice how each transaction has a two-fold effect on the balance sheet with one account being credited and another debited. This is the essence of double-entry bookkeeping and is what’s needed to ensure that the net capital value shown in bold-type in the bottom right corner of the balance sheet is equal in value to the difference between the assets and liabilities, a figure which is shown underlined and in bold-type directly beneath the liabilities sum-total figure. If the two figures are equal, then your books balance. If you fail to make these two sides of the accounting equation balance, then this constitutes clear evidence that at least one mistake has been made during the recording, classifying and double-entry phases of the accounting process.

Let’s look at transactions 1 and 7 above as examples of how this two-fold effect on our accounts ensures both sides of our accounting equation come to the same value, thereby balancing the books.

Transaction 1. Debtors pay their accounts £2,750 by cheques and cash.

In the assets column, we reduce (credit) the ‘debtors’ value of £4,500 by £2,750 giving a new debtors total of £1,750. At the same time, we must increase (debit) our ‘bank’ assets by £2,750 giving a new bank total of £6,750. In effect, our assets total remains unchanged at £102,500, and since we haven’t touched the liabilities column, we still have a capital worth of £22,500 given by £102,500 – £80,000.

Transaction 7. Stock is sold to debtors for £3,000 having cost £2,000.

This is the only transaction listed where we have to make three changes to our balance sheet instead of two to ensure our books balance. Here, our stock value decreases by £2,000 and our debtors total increases by £3,000. In other words, the net effect is that assets increase overall by £1,000 and so the difference between our assets and liabilities is now £1,000 greater. But if we do not reflect this in the Capital column, our books will not balance and our capital sum will be trailing our ‘Assets – Liabilities’ sum by £1,000. To balance the books, we must add £1,000 somewhere to our Capital column. We do this quite simply by adding £1,000 to the profit figure. Now our books balance nicely.

These concepts will be explored in more detail in chapter 8 entitled ‘Double-entry Bookkeeping’.